What Is Prospect Research? The Founder's Guide to Smarter Outreach

Learn what is prospect research and how it helps you uncover high-value leads. Discover strategies to find better prospects and scale your outreach.

Let's be real—as a founder, you hate getting generic, copy-pasted sales pitches. Prospect research is the secret sauce that stops you from being that person. It's the detective work you do before ever hitting "send" on a cold DM.

Think of it as creating a quick brief on your ideal customer. This isn't about being creepy; it's about understanding. The goal is to make every message feel personal and genuinely helpful. This is what turns a cold outreach on Twitter into a warm conversation that actually leads somewhere.

So, What Is Prospect Research, Really?

Prospect research is just the process of learning who your potential customers are, what they care about, and why they might need your SaaS. It’s the first step that powers every successful lead generation effort.

You’re trying to answer a few key questions before you make contact:

- Who is feeling the exact pain point my product solves?

- What clues are they leaving on Twitter that show they need a solution now?

- Why is my offer the right one for their specific situation?

Getting these answers is what separates founders who blast out generic DMs from those who start real conversations that lead to new customers.

It’s More Than Just a Quick Google Search

The idea isn't new, but for SaaS founders, its importance has exploded. Prospect research actually started in fundraising, where finding the right donors was a make-or-break activity. With donor numbers dropping—we saw 3.4% fewer donors and 2.8% fewer dollars in 2023—this focused research became a survival strategy.

For us, the game is the same. You're not looking for donors; you're hunting for perfect-fit customers on platforms like Twitter. It all boils down to being smart with your most precious resource: your time.

Prospect research flips your outreach from a game of luck to a game of skill. You stop guessing who to talk to and start knowing exactly why they should listen.

From Generic Blasts to Targeted Conversations

The difference this research makes is night and day. It transforms your outreach, making it more effective and, frankly, more human.

| Outreach Element | Without Prospect Research | With Prospect Research |

|---|---|---|

| Targeting | "Spraying and praying" to a broad list. | Focusing on a handpicked list of high-fit leads. |

| Messaging | One-size-fits-all, generic templates. | Personalized DMs that reference their specific role, company, or recent tweets. |

| Response Rate | Low, often single digits. | Significantly higher, leading to more conversations. |

| Outcome | Annoyed prospects, marked as spam. | Genuine replies, booked meetings, and new customers. |

Ultimately, this methodical approach ensures every DM is loaded with relevance. That relevance is what earns you a response and gets that first meeting booked.

Why Good Research Is Your Unfair Advantage

Let's be honest, doing homework on prospects can feel like a chore. But it’s the single biggest edge you can give your outreach, especially on a crowded platform like Twitter. This is where you stop throwing darts in the dark and start hitting the bullseye.

When your outreach is sharp and relevant, your response rates skyrocket. Instead of getting lost in the noise, you get actual replies because you’ve shown you understand the person on the other end.

Go from Chasing to Attracting

This shift changes how you go to market. Sales cycles get shorter because you're talking to the right people about problems they actually have. No more wasting weeks trying to convince a prospect they have an issue—your research confirms you already know they do.

For founders, this is a game-changer. It means you stop burning hours on leads that go nowhere. Think of it as the difference between casting a giant, empty net and spearfishing for high-value targets. It’s all about precision over volume.

This focus helps you build a predictable, high-quality sales pipeline—the dream for any SaaS. You start to see patterns in who buys and why, building a foundation for scalable growth.

The goal of prospect research isn't just to find more leads. It’s to find the right leads, faster, and arm yourself with the intel to turn a cold DM into a warm conversation.

The Real Impact on Your Bottom Line

At the end of the day, the time you put into research pays you back in pure efficiency and revenue. Your customer acquisition cost (CAC) drops because you’re not wasting time on people who were never going to buy. Your conversion rates climb because every conversation is more meaningful.

Just look at your own experience on Twitter. A generic, copy-pasted DM is an instant ignore. But a message that references a specific pain point you just tweeted about? That’s almost impossible to dismiss.

This is where smart tools give you a massive leg up. For instance, a platform like DMpro can automate this by scanning for buying signals on Twitter. It finds someone complaining about a problem your SaaS solves and helps you jump in instantly with a relevant message. It turns the tedious, manual part of research into an automated advantage, so you can focus on building relationships and closing deals.

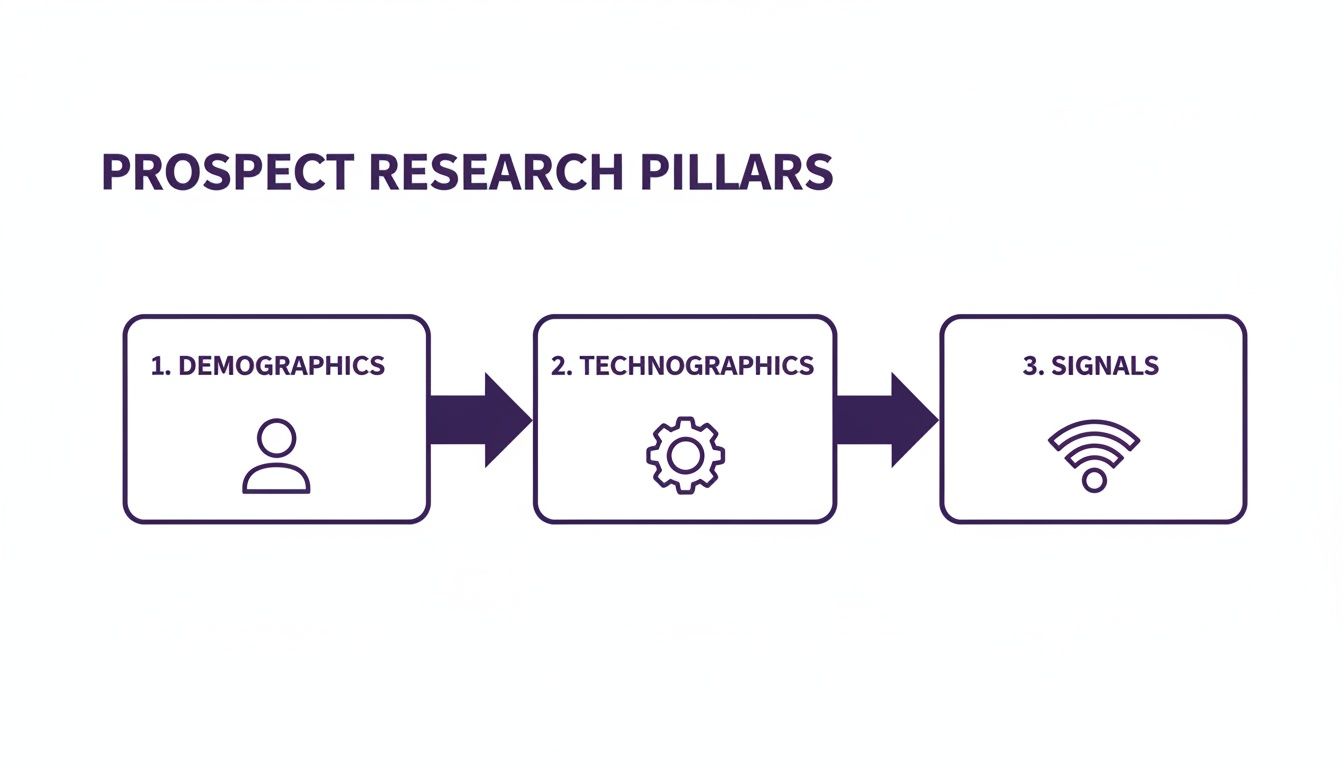

The Three Pillars of Effective Prospect Research

To get real, actionable results, you can't just treat research as one giant to-do list. Breaking it down into three core pillars helps you organize what you find and quickly see what matters. Think of it as building a complete picture of your ideal customer, one layer at a time.

The goal isn't to hoard random facts. It's about building a profile that tells a clear story: who a prospect is, what they need, and when they might be ready to listen. Getting this right starts with solid information organization, which is why mastering the basics of research data management is so crucial.

Pillar 1: Demographics

This is your ground floor—the "who" and "where." Demographics give you the basic context to qualify a prospect right off the bat.

- For a B2B SaaS Founder: This means looking at company size, industry, annual revenue, and a contact’s specific job title. Are you selling to a 20-person startup or a 2,000-employee enterprise? Is your contact the VP of Marketing or a junior developer?

These details are fundamental. They let you filter your list down to only the most relevant companies and decision-makers, so you aren’t wasting time on outreach that’s dead on arrival.

Pillar 2: Technographics

Next, you dig into the "what." Technographics reveal the tech a company already uses. What software are they paying for? This is like getting a peek inside their digital toolbox, which tells you a ton about their priorities and budget.

Are they a Salesforce shop or a HubSpot user? Do they use Stripe for payments? Knowing their tech stack helps you understand if they’re a perfect fit or a competitor’s customer you could win over.

Pillar 3: Buying Signals

This is where the magic happens for scaling distribution. Buying signals are all about the "when" and the "why." These are real-time clues that show a prospect is actively looking for a solution. This pillar is what makes your timing perfect.

Buying signals turn your research from a static profile into a dynamic, actionable insight. They tell you not just who to contact, but who to contact right now.

Think about these real-world examples you can easily spot on a platform like X (formerly Twitter):

- Hiring: A company posts a job for a new "Head of Sales." This is a huge signal they're investing in growth and might need new sales tools.

- Funding Announcements: A startup tweets about closing its Series A round. This means fresh capital is available to spend on solving growth challenges.

- Public Complaints: Someone posts, "Does anyone know a good alternative to [Competitor Product]? Ours keeps crashing." This is a direct invitation to start a conversation.

Focusing on these signals is especially important in a tight market. For instance, recent fundraising data showed that in 2023 there were 3.4% fewer donors and 2.8% fewer dollars given compared with 2022. This kind of volatility makes it vital to know exactly which prospects to focus on, and buying signals give you that clarity. You can find more fundraising effectiveness findings that highlight this trend.

Building Your First Prospect Research Workflow

Alright, theory is great, but let's get into the weeds. A good prospect research workflow isn’t some complicated system. It's a lean, repeatable process that turns raw information into real conversations and scales your distribution.

The goal is to build a simple machine you can run consistently without it becoming a huge time-sink.

It all starts with getting crystal clear on your Ideal Customer Profile (ICP). If you don't know exactly who you're looking for, you'll waste countless hours. Define their role, company size, industry, and the specific pain points you solve.

Finding Your Gold Mines

With your ICP locked in, figure out where these people hang out and leave digital breadcrumbs. For SaaS founders, these are often the most valuable sources for lead generation:

- Twitter's Advanced Search: This is an underrated powerhouse. You can filter by keywords (like "anyone know a tool for X?"), hashtags, and even negative keywords to find people discussing problems you solve.

- LinkedIn Sales Navigator: An absolute must for B2B. It lets you zero in on specific job titles, company sizes, and recent job changes—a huge buying signal.

- Industry Job Boards: A company posting a job for a "Head of Growth" is a massive signal they're investing in scaling. That's your cue to reach out.

This is all about connecting the dots between who someone is, what tools they use, and what they're doing right now. You’re essentially looking for three pillars of information: demographics, technographics, and buying signals.

When you see how basic company info, their tech stack, and their real-time activity come together, you get a full picture of the opportunity.

Organizing Your Intelligence

Finally, you need a simple way to track what you find. This doesn’t have to be a fancy CRM. A basic Google Sheet with columns for Name, Company, Twitter/LinkedIn Profile, and a "Personalization Angle" is more than enough to get started.

That personalization angle is the key—it's the specific data point you'll use to make your outreach feel human.

The entire workflow can be simplified with the right tools. Instead of manually searching Twitter every day, you can explore no-code automation to handle the heavy lifting. Platforms like DMpro can watch for buying signals 24/7, find prospects that match your ICP, and feed them right into your pipeline. This frees you up to craft the perfect message.

How to Automate Your Research with Smart Tools

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/4hRJeel7aPk" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Manual research is great for getting started, but it doesn't scale. As a founder, your time is your most valuable currency. This is where outreach automation becomes a game-changer for your SaaS distribution.

Modern platforms do the heavy lifting of finding, qualifying, and enriching leads for you. It's the difference between panning for gold by hand and having a machine that brings the nuggets right to you.

Turning Research into a 24/7 Engine

Think of these tools as an automated research assistant that never sleeps. A platform like DMpro.ai, for example, is built to do this on Twitter. You just tell it who you're looking for—say, a SaaS founder who recently tweeted about "hiring engineers"—and it goes to work.

The tool constantly scans thousands of profiles, hunting for perfect-fit prospects based on real-time buying signals. What was once a tedious manual chore becomes a lead-gen engine that runs 24/7, fueling your growth.

The goal of automation isn't just to do things faster; it's to do the right things at a scale you could never achieve on your own. It's about systemizing your pipeline so growth becomes predictable.

The market for these tools is exploding. The donor prospect research software market alone is expected to reach around $800 million by 2025 and is growing at a 12% CAGR through 2033, largely thanks to AI. In practice, this means AI can sift through millions of data points to find your ideal customers—just like how DMpro can scan X to surface over 500 targeted leads every single day. You can read more about this market growth on datainsightsmarket.com.

Choosing the Right Tools for Your Stack

You don't need a huge, complicated tech stack to get started with automation. Many founders see great results by combining just a few key platforms. Our guide on the best prospecting tools for sales is a good place to start comparing your options.

The secret is to find tools that handle the most repetitive parts of your workflow. To stay ahead, it's also smart to explore resources on the best sales prospecting tools for automation to see what's on the horizon. When you offload the grunt work, you finally get the time to focus on high-level strategy and scaling your SaaS.

Turning Your Research Into Revenue

This is where the rubber meets the road. Prospect research isn't just an academic exercise—it’s how you draw a straight line from a piece of information to a booked demo.

Picture this: you're a SaaS founder scrolling through Twitter. You find a tweet from a potential customer asking their network for recommendations on a problem your tool solves perfectly. This is a classic buying signal, a live flare showing they're actively hunting for a solution.

From Signal to Sale

Without research, the temptation is to fire off a generic DM. "Hey, check us out!" But with a solid process, your approach is infinitely more effective. You take a few minutes to understand who they are and what their company does.

Armed with that context, your DM is completely different. Instead of a bland pitch, you can reference their specific tweet and offer real value. Your message instantly proves you understand their problem. That's how you get a reply.

Prospect research isn't just about finding leads. It's about finding the right conversation starter at the perfect moment to turn a cold outreach into a warm opportunity.

That simple, targeted message starts a genuine conversation, which is far more likely to lead to a demo. Good prospect research is the foundation of any predictable sales engine, especially for scaling your SaaS distribution. It helps you focus your time on the people who are actually likely to buy.

To get even more strategic, check out our guide on what is lead scoring and see how it fits into this workflow.

Ultimately, this approach ensures every interaction you have is relevant and makes an impact. It's the difference between shouting into the void and starting meaningful conversations that drive your business forward.

If you’re tired of manually sending DMs every day, try DMpro.ai — it automates outreach and replies while you sleep.

Your Prospect Research Questions Answered

Got a few lingering questions? I get it. When you're growing your SaaS, you need clear, straightforward answers. Here are some of the most common questions I hear about prospect research, with no fluff attached.

How Much Time Should I Spend on Research for Each Prospect?

I live by the 5-minute rule. Can you find one solid, personal angle in five minutes or less? This could be a recent tweet, a new job announcement on LinkedIn, or a quote from a podcast.

If you find yourself scrolling endlessly past that five-minute mark, move on. You're either going too deep, or that prospect doesn't have enough of a public footprint. The key is to find that one golden nugget and get on with your outreach.

Is This Just Something for Big Sales Teams?

Not at all. It's even more crucial for solo founders and small teams. When your resources are tight, you can't afford to waste time sending generic messages that get ignored.

Every single DM has to count. Doing your homework upfront ensures each one has the best possible shot at sparking a real conversation, making your limited time and effort go way further.

When Should I Bring in Automation Tools?

The moment you have a crystal-clear Ideal Customer Profile (ICP). Once you know exactly who you're targeting, outreach automation tools can do the grunt work of finding them for you.

For example, say your best customers are SaaS founders tweeting about hiring challenges. A tool like DMpro can monitor Twitter for those specific conversations. This lets you stop the manual searching and jump straight into engaging with people who are already talking about the problems you solve, which is key to scaling your distribution.

I've put together a quick table to summarize these points.

Your Prospect Research Questions Answered

| Question | Answer |

|---|---|

| How much time is too much? | Stick to the 5-minute rule. If you can't find a personalization hook in 5 minutes, it's time to move on to the next prospect. |

| Is this only for large teams? | No. It's especially vital for solo founders and small teams where every single outreach effort needs to have a high impact. |

| When should I use automation? | As soon as your Ideal Customer Profile (ICP) is well-defined. Automation helps you find qualified prospects at scale. |

| What's the main goal of the research? | To find a single, genuine reason to start a conversation. It's not about creating a massive dossier; it's about finding a human connection point. |

Hopefully, that clears things up! The goal isn't to become a private investigator but to be thoughtful and relevant in how you approach people.

If you’re tired of manually sending DMs every day, try DMpro. It automates outreach and replies while you sleep. Learn more at https://dmpro.ai.

Ready to Automate Your Twitter Outreach?

Start sending personalized DMs at scale and grow your business on autopilot.

Get Started Free